Financial Action Task Force(FATF) and Myanmar's military Junta

The Financial Action Task Force (FATF) has added Myanmar to its category of “high-risk jurisdictions subject to a call for action” popularly referred to as the “Blacklist”. The statement from FATF stated that Myanmar continuously showed a lack of progress in its action plan which was due to be completed by October 2022 [1]. Therefore, the FATF moving forward with the procedure has called to apply due diligence measures to its members and other jurisdictions marking the first time that FATF has ever put Myanmar on the “call for action” list. This development will leave corporations or other financial entities operating in Myanmar with difficult and burdening reporting on compliance. The statement further stated that the due diligence should not in any way disrupt the flow of funds meant for humanitarian purposes, remittances, or legal Non-Profit Organisation (NPO) activities.

FATF stated that Myanmar needs to address its deficiencies in meeting the action plan and needs to demonstrate an improved understanding of risks regarding money laundering (ML), risk-based on-site and off-site inspections with hundi operators being registered and supervised, use of financial intelligence in Law Enforcement Investigation (LEA) investigations and enhanced operational analysis and distribution of Financial Intelligence Unit (FIU), risk-based ML investigations, international cooperation in transnational ML investigations, enhanced confiscation of criminal proceeds, properties or equivalent value, management of seized assets and implementing targeted sanctions regarding proliferation financing (PF).

FATF Black and Grey Lists.

The FATF was established in 1989 as an inter-governmental decision-making body in the G7 Summit to formulate policies to counter instances of money laundering. As a policy-making body, it aims to create the political will to bring legislative and regulatory reforms to counter money laundering. The FATF also identifies vulnerabilities at the national level in order to protect the global monetary system from any misuse. FATF became more prominent in countering terror financing after 9/11. FATF generates two types of lists, namely, the Black List which includes countries known as Non-Cooperative Countries or Territories (NCCTs), and the Grey List which includes countries that are considered safe for funding terror groups and money laundering. The inclusion of any country in the Grey List is usually a warning indicating that the country might get added to the Black List (2). As of 2019, the Black List includes Iran and North Korea for terror financing with 12 countries on the Grey List.

Implications upon inclusion on the Lists:

The countries put on the Black List by FATF are considered inadequate in ML and tackling the financing of terror regimes and it calls members of all nations that are considered high-risk and further encourages all subsequent jurisdictions to take due diligence. In certain serious cases, nations are also called to implement appropriate countermeasures for the protection of the global monetary system. Also referred to as the FATF Anti Money Laundering (AML) deficient list, the country on the blacklist might be subjected to economic sanctions by any member of the FATF. Other countries can also be added to the list given their Anti-Money Laundering and Terrorist Financing (AML/CFT) regulations are not met with the FATF standards and fail to comply with the recommendations proposed by the FATF [3]. According to the FATF, the lists it publishes have strategic shortcomings in countering cases of money laundering and terror financing. Here, it must be noted that although the FATF operates as an international decision-making body, it does not have direct investigative authority, however, it does act as an international watchdog keeping an eye on the global AML/CFT regimes.

Countries on the Black List are faced with financial penalties and other measures by member countries of the FATF and other international entities. Apart from the negative impact on the national economy, the impact of inclusion on FATF lists can also differ based on what grounds a country is added to the lists. For instance, inclusion on grounds of terror financing is met with more severe consequences [4]. Further implications include economic sanctions being imposed by international financial entities like the International Monetary Fund (IMF), Asian Development Bank (ADB), and the World Bank, a decline in international investment, trade and flow of foreign currency, delay in payments, downgrade in sovereign credit and business ratings by rating agencies, rise in costs of cross-border transactions, restrictions in nesting and downstream correspondent financial links, a decline in trust factor of the national financial bodies and delinking of regional financial entities from the globe. Coincidentally, with the regulated banking system being cut off from its international ties due to the country’s financial system being under increased scrutiny, channels for money laundering increases.

Implications for Myanmar:

Myanmar had been in the Gray List in 2016 and its inclusion in the Black List makes it the third country after North Korea and Iran. According to Daw Than Than Swe, the Chairman of the Central Bank in the regime stated that he had been attempting to make Myanmar come out of the Gray List. Further comments from the business community pointed out the prospects of foreign investment and job opportunities to face severe impact and trade relations of Myanmar with other economies being weakened which would further choke its participation in the international economy. Additionally, the increase in the value of the dollar would also bring more challenges to oil imports. Given that the national economy of Myanmar and the manufacturing sector are in decline, the inclusion could bring difficulties for the citizens. Further comments from experts in business and finance have also stated that the opportunities to receive assistance or funds from the international community are also likely to get limited [5]. However, FATF action towards Myanmar comes with an exception where the due diligence by member nations should not in any way disrupt humanitarian assistance [6].

Military Regime’s challenges with the economy:

The military regime in Myanmar has brought economic turmoil since the first day it took over the government. Upon the coup, the military authorities disconnected the internet and telephone lines and disrupted ATM services all across Myanmar. When the communication services were restored, citizens in a mass panic rushed to ATMs. In response, the military government put a withdrawal limit on both ATMs and banks. The initial cash withdrawal limit of 500,000 kyats per person per day was brought down to 200,000 kyats which went further down to 100,000 kyats. This move created further panic among citizens as the population was left with difficulties in accessing their own money during economic turmoil. The military government invited fresh investment projects in an attempt to stabilize the economy. For instance, the government reorganized the Myanmar Investment Commission (MIC) appointing Lt. Gen. Moe Myint Tun as the Chairman. The first initiative by the re-organized MIC under the chairmanship of Moe Myint Tun was the approval of projects worth 579 million USD and the creation of 94 job opportunities. Here, it should be noted that Moe Myint shares familial ties with General Maung Aye, the second-in-command in the previous military regimes. Moe Myint rose through the ranks becoming the youngest general in history owing to his accomplishments in the War Office, however, he lacks the experience required for managing economic affairs at the national level [7]. While the business community had hopes that the military regime would be able to tackle economic sanctions posed by the Western nations by receiving Chinese capital injections worth billions of dollars. However, these hopes were not met by the Chinese side possibly either due to China’s reluctance to support the military regime or due to concerns regarding the political stability of Myanmar. As per the official data from Myanmar, Chinese investments during the government formed by the National League for Democracy (NLD) stood at 6.6 billion USD which decreased to 175.8 million USD by 2021. Further, China has not proceeded with any bailouts apart from facilitating humanitarian aid and assistance under China’s Covid-19 diplomacy.

Since February 2021, Myanmar has not made any significant exports while foreign investors are contemplating exiting the country. Further, the rich class of Myanmar has also transferred its cash out of Myanmar through formal or informal channels. A former staff of a Japanese Bank speaking anonymously stated that the rich citizens of Myanmar have transferred around 80 percent of their wealth to other countries like Dubai, Singapore, and Thailand. Additionally, the Real Estate Information Center of Thailand also reported that after the Chinese, Burmese citizens have come out as the second largest foreign buyers of housing units. Therefore, it can be said that the subsequent implications regarding political instability due to the military takeover have triggered an economic collapse while the regime’s mismanagement in stabilizing the economy by bringing new investments and controlling the currency and foreign exchange have only deteriorated the economic condition of Myanmar.

Myanmar is already under the imposition of economic sanctions by the West and Bloomberg News reported that the Monetary Authority of Singapore has stated that the banks under its jurisdiction do not have any significant funds from individuals or companies in the country and the financial entities have been put on high alert regarding risks that may come out of the economic situation in Myanmar [8].

While the inclusion of Myanmar in the Black List is considered a vote of no-confidence in the military junta, the reason that led to the inclusion predates the military coup [9]. According to T. Raja Kumar, the President of FATF, the failures in compliance were earlier identified back in September 2018 adding that he persuaded the Myanmar authorities to complete their action plan in order to address the identified strategic deficiencies in Myanmar.

Conclusion:

The inclusion of Myanmar in the FATF Black List amplifies the range of problems that the military regime is already facing. With the continuing weak economy, the implication of Black List inclusion is likely to make its function in the global market more difficult. Here, it must be noted that its inclusion in the Gray List prior to the military coup had already indicated the possibility of being added to the Black List. Additionally, the decrease in economic engagement with China has made tackling challenges more difficult for the government. In this regard, Myanmar is left with no option but to comply with the recommendation proposed by the FATF. The move by FATF is a huge challenge for the military regime while the banks and other financial institutions remain external to the mainstream international monetary system reducing the pool of foreign entities in Myanmar as they might not see any profitable returns from the country.

Endnotes:

1. “High-Risk Jurisdictions subject to Call for Action – 21 October 2022, Financial Action Task Force, 21 October 2022 https://www.fatf-gafi.org/publications/high-risk-and-other-monitored-jurisdictions/documents/call-for-action-october-2022.html

2. “What is FATF”, Business Standard, https://www.business-standard.com/about/what-is-fatf

3. “FATF Blacklists and Greylists”, Sanctions Scanner https://sanctionscanner.com/knowledge-base/fatf-blacklists-and-greylists-171

4. Financial Crime Editorial, “The Implications of FATF Greylist and Blacklist”, Financial Crime Academy, https://financialcrimeacademy.org/the-implications-of-fatf-greylist-and-blacklist/#mcetoc_1fg6v3clt4

5. “Myanmar to face nightmare over FTAF’s blacklist”, BNI Multimedia Group, 24 October 2022 https://www.bnionline.net/en/news/myanmar-face-nightmare-over-fatfs-blacklist

6. Sebastian Strangio, “International Financial Watchdog Adds Myanmar to Blacklist”, The Diplomat, 24 October 2022 https://thediplomat.com/2022/10/international-financial-watchdog-adds-myanmar-to-blacklist/

7. Wai Moe, “Myanmar Coup Makers’ Major Challenge is a Failing Economy”, Fulcrum Analysis on Southeast Asia, 20 September 2022 https://fulcrum.sg/myanmar-coup-makers-major-challenge-is-a-failing-economy/

8. “Myanmar put on FTAF’s ‘black list’ over money laundering risks”, Hindustan Times, 22 October 2022 https://www.hindustantimes.com/world-news/myanmar-put-on-fatf-s-black-list-over-money-laundering-risks-101666422933420.html

9. Sebastian Strangio, “International Financial Watchdog Adds Myanmar to Blacklist”, The Diplomat, 24 October 2022 https://thediplomat.com/2022/10/international-financial-watchdog-adds-myanmar-to-blacklist/

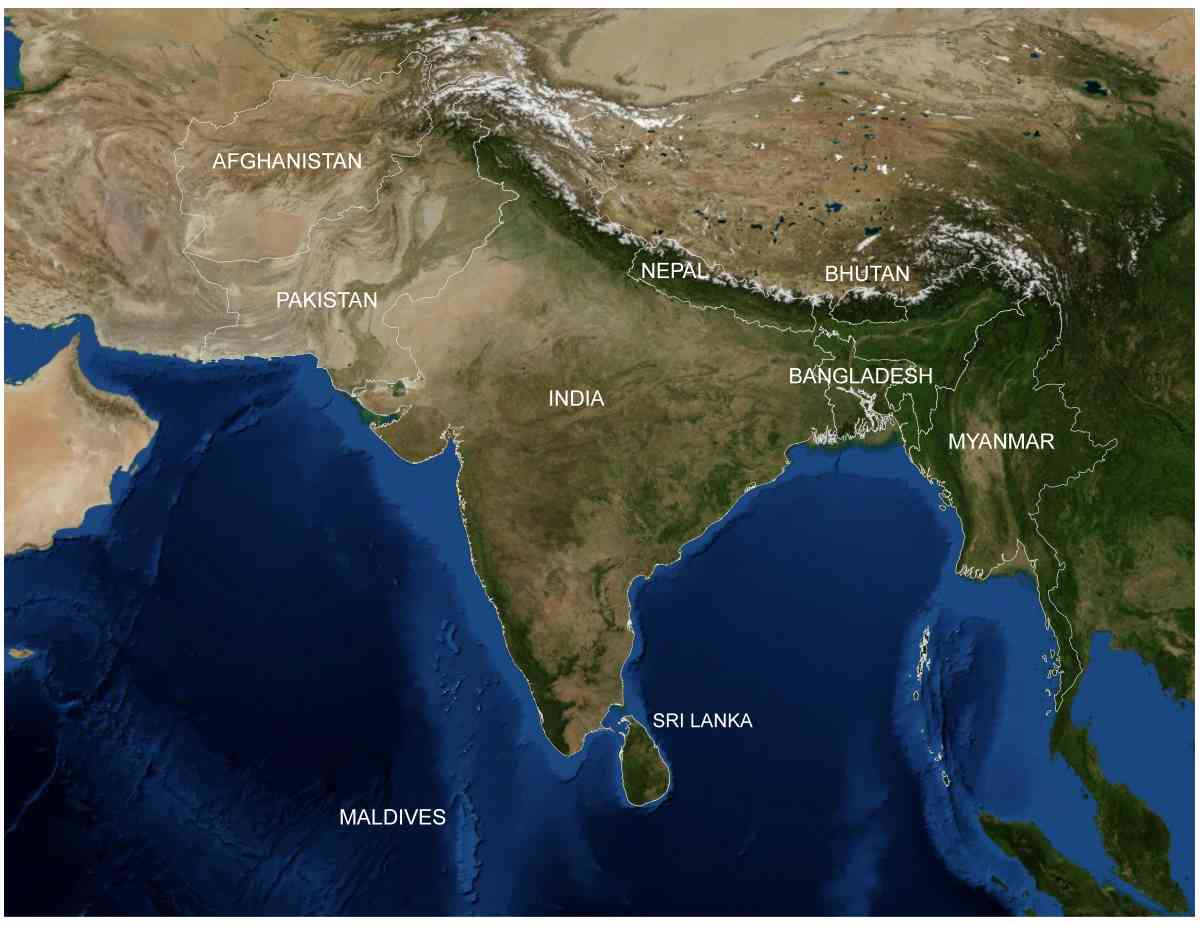

Pic Courtsey-IDSA GIS lab

(The views expressed are those of the author and do not represent views of CESCUBE.)